Indicators on Mortgage Refinance Deal You Need To Know

Table of ContentsThings about Mortgage Refinance DealWhat Does Refinance Deals Do?The 8-Minute Rule for Best Refinance DealsBest Refinance Deals Can Be Fun For AnyoneRefinance Deals - TruthsRumored Buzz on Refinance DealsNot known Incorrect Statements About Mortgage Refinance Deal Not known Factual Statements About Best Home Loan Refinance Offers

You have your main home loan, and now you're taking a second loan versus the equity you have actually integrated in your home. The second loan is secondary to the firstshould you default, the second lending institution stands in line behind the first to gather any earnings due to foreclosure. best refinance offers. House equity loan rates of interest are generally higher for this factor.There are a number of advantages to house equity loans that can make them appealing choices for property owners seeking to minimize their monthly payments and simultaneously release a swelling amount. Refinancing with a home equity loan can provide: Lower, repaired rate of interest than your previous home mortgage, Lower monthly payments due to lower rate of interest and a smaller sized principal, A swelling sum that can be utilized for any purpose, consisting of renovations and improvements to your home that, in turn, can raise its value On the other hand, home equity loans included threats that you should know: Your home protects the loan, so your house is at threat if you fall back on your loan repayments.

Some Of Best Home Loan Refinance Offers

If you don't wind up requiring the entire quantity, you can be stuck paying interest on a part of the loan you do not use. This is why HELOCs are a better choice for house owners who require to cover continuous, unforeseeable expenses. You can't get a home equity loan with too much debt or poor credit.

There are several reasons why you may pick a cash-out refinance over a house equity loan. In principle, a cash-out re-finance gives you the quickest access to the cash you've currently purchased your home. With a cash-out refinance, you pay off your existing mortgage and enterinto a new one - refinance deals.

Refinance Deals Can Be Fun For Anyone

On the other hand, cash-out refinancing tends to be more pricey in regards to costs and portion points than a home equity loan is. You will also require to have a great credit history in order to be authorized for a cash-out re-finance because the underwriting standards for this type of refinancing are generally higher than for other types - best refinance offers.

The cost of house equity loans tends to be lower than cash-out refinancing, and this type of refinancing can be far less complex. House equity loans likewise have drawbacks.

Unknown Facts About Best Home Loan Refinance Offers

In other words, with a cash-out refinance, you obtain more than you owe on your mortgage and pocket the difference. Not typically. You do not have to pay income taxes on the cash you get through a cash-out re-finance. The cash you gather from a cash-out refinance isn't thought about income.

Rather of income, a cash-out re-finance is simply a loan. Cash-out refinancing and house equity loans can benefit property owners who wish to turn the equity in their houses into money. To choose which is the very best move for you, think about just how much equity you have offered, what you will be utilizing the cash for, and for how long you plan to remain in your house (best home loan refinance offers).

All About Best Refinance Offers

.png)

This will not only indicate you're home mortgage totally free faster, however will likewise conserve you on interest. When you were wading into the world of house loans for the very first time, you might have decided to keep things easy with a standard no-frills option. And now that you have actually had that loan for a couple of years (or a years) you might wish to refinance to an option with a couple of more functions, like a balanced out account, additional payments or a redraw center.

Rumored Buzz on Best Refinance Offers

When you have actually settled a few of your loan and your LVR reduces, you might have the ability to snag a better rate of interest. Possibilities are, some things have actually changed since you initially registered for your home mortgage. Perhaps you got a new task, or you had kids, or you settled other debts that were dragging you down.

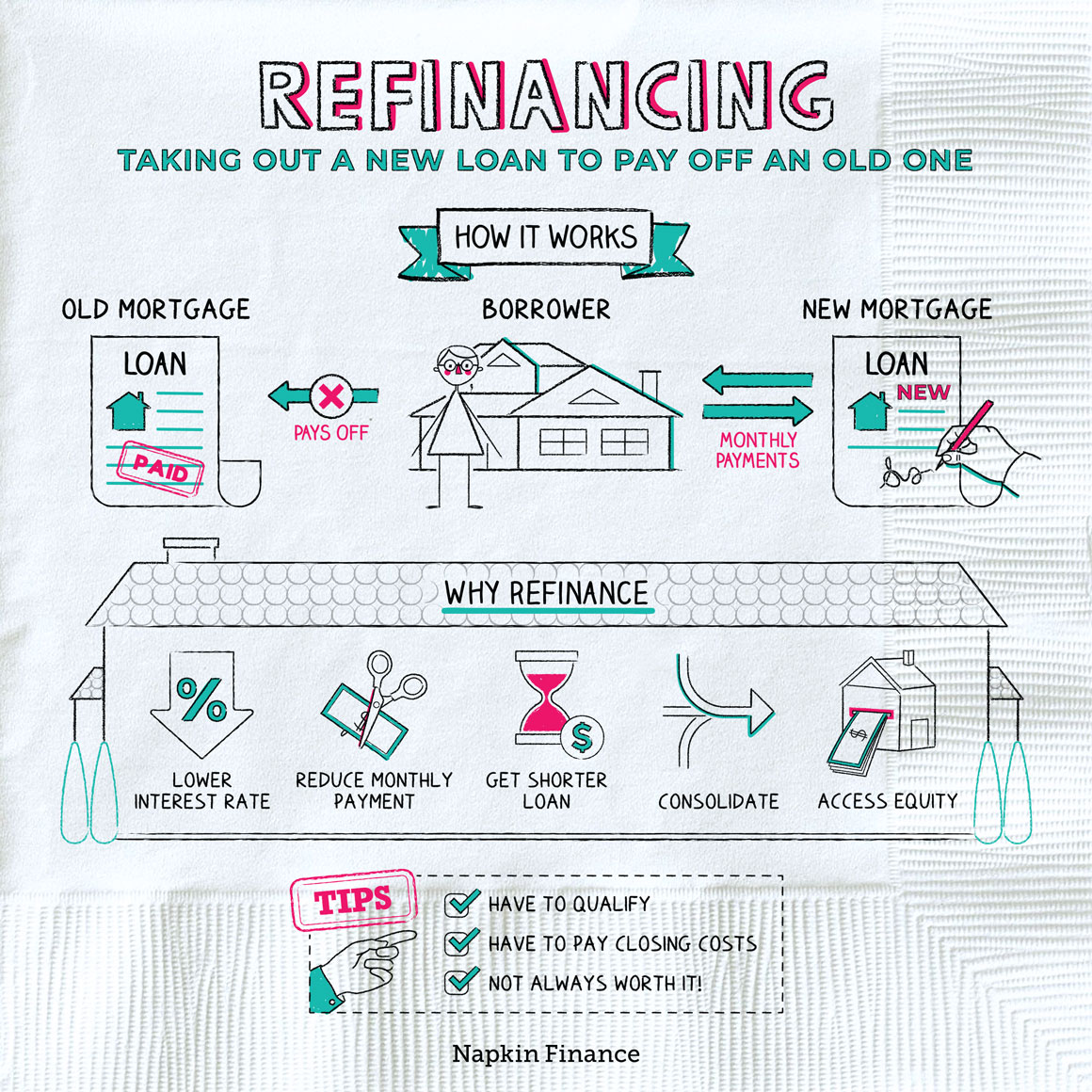

It's always an excellent concept to evaluate your home mortgage every few years, to make sure that you're still getting a bargain. When you have actually reviewed it you may even begin thinking of refinancing. Refinancing your home mortgage just implies that you take out a brand-new home mortgage to replace your old one.

Best Refinance Deals Can Be Fun For Everyone

When you change mortgage you will more typically than not have to utilize some or all of the funds to settle Home Page your old home mortgage - web link best home loan refinance offers. Depending on what works best for you or what offers are readily available when you're seeking to refinance, you can either stick to your existing lending institution or switch to a brand-new one totally.

6 Simple Techniques For Mortgage Refinance Deal

60% interest. If you've chosen to re-finance your house loan to a much better deal, now comes the tricky part of finding the ideal house loan to change.

Comments on “The Refinance Deals Diaries”